Hypercharge your business with embedded finance

Omnio provides the infrastructure to seamlessly plug innovative financial products into the digital channels of retailers and banks.

Omnio provides the infrastructure to seamlessly plug innovative financial products into the digital channels of retailers and banks.

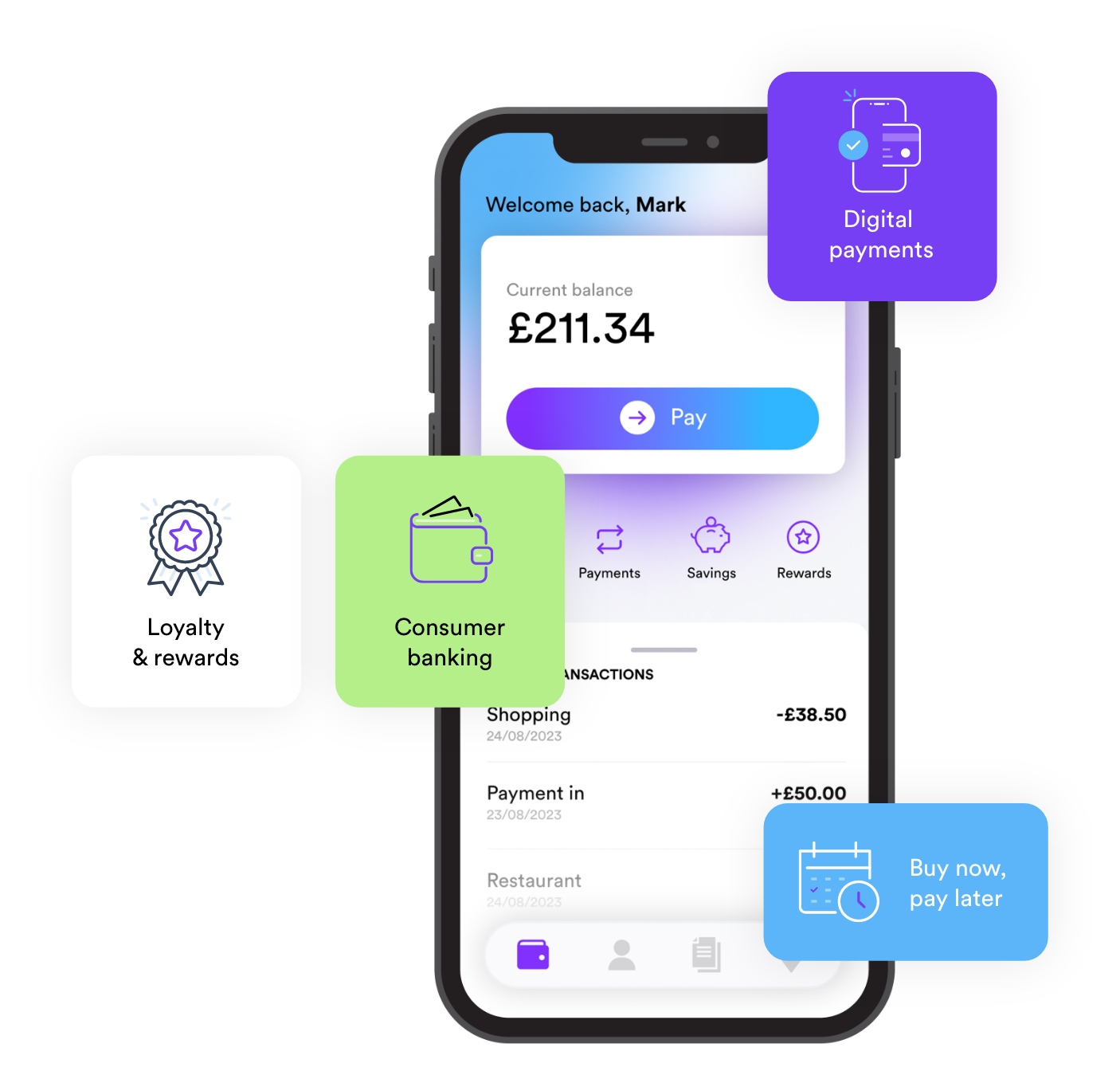

The OMNIO Platform brings together the latest technology in core banking, payments, retail lending and loyalty & rewards, serving as a secure foundation to manage all regulatory complexities.

Power your digital banking products with our cost-effective infrastructure.

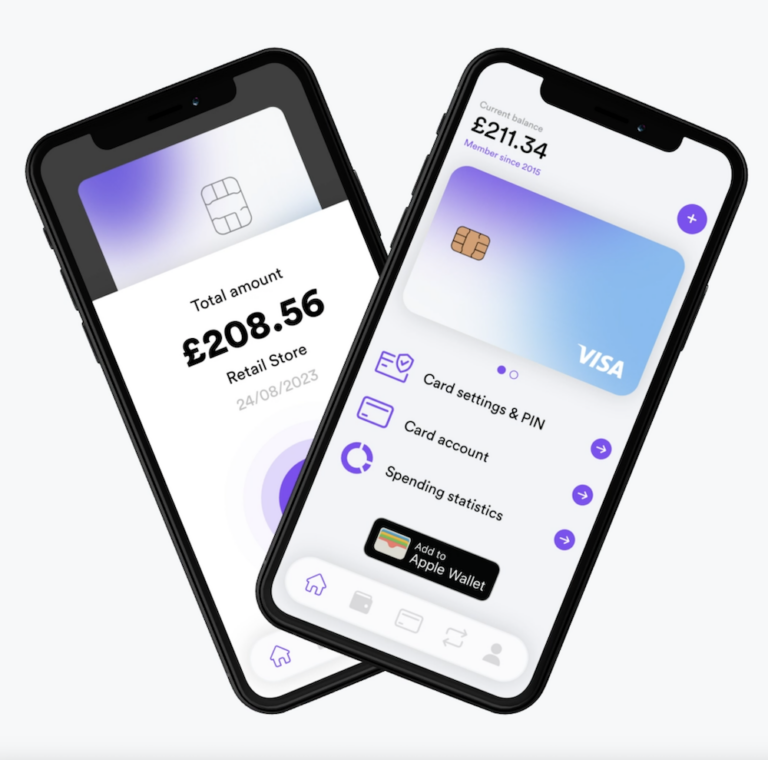

Unlock comprehensive local and cross-border payment solutions, both closed and open loop.

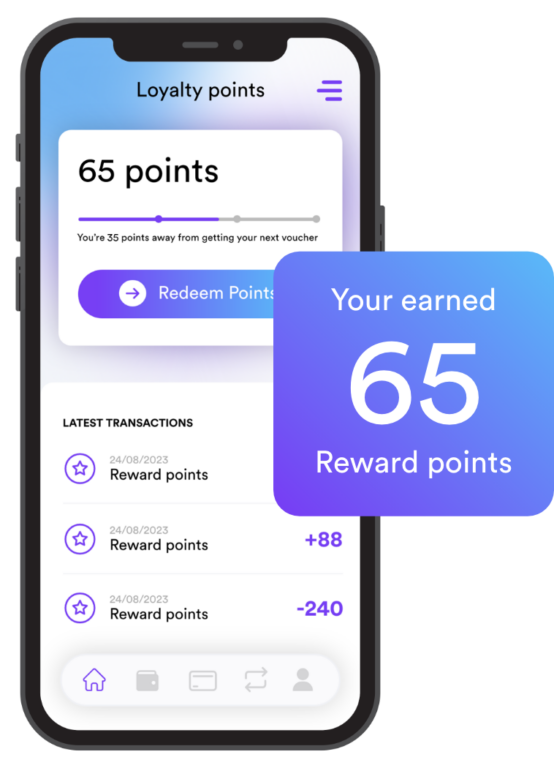

Enable smooth reward issuance and redemption alongside every transaction.

Seamlessly integrate loyalty features into the payment and checkout experience.

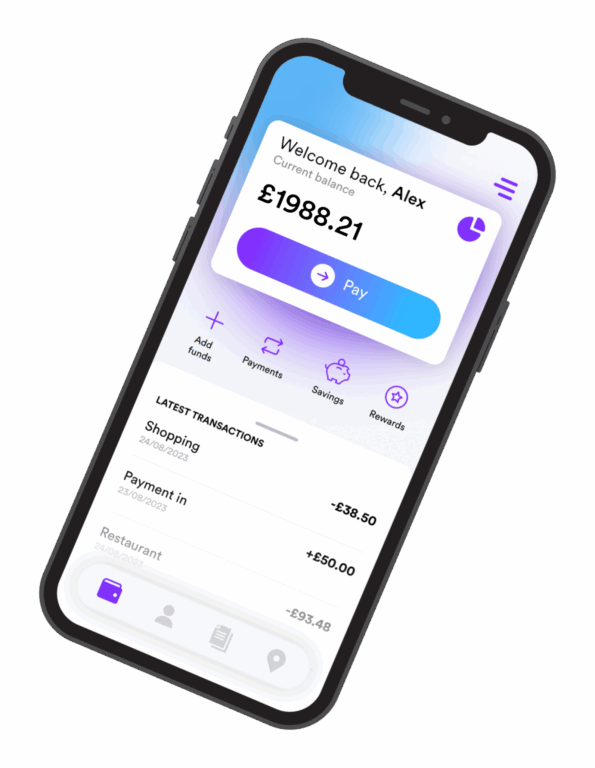

With our banking-as-service offer, our clients can embed financial products without the need to become a fully regulated financial institution. Omnio takes care of all regulatory, compliance and service matters, so our clients can focus on delivering the best experience to their customers.

Our cost-effective white label products are easy to integrate and unlock new opportunities for our clients, helping their customers do more with their money.

We collaborate with leading organisations in markets that need to keep up with growing customer demands and expectations.

We help trusted consumer brands tap into the potential of embedded finance, while maintaining full control of their customer experience.

Boost your revenue by earning fees, commissions and revenue sharing on financial products.

Keep customers engaged by offering financial products when they need them and stop them leaving your channels for third-party providers.

Simplify purchasing for your customers with innovative and flexible payment solutions designed to enhance the checkout experience.

Streamline payment services, reducing costs and speeding up settlements by integrating your own system.

Retain loyal customers with a comprehensive range of financial services tailored to their needs.

Leverage valuable customer insights to personalise offers, target marketing and make data-driven decisions.

By offering financial products at the point of need, our clients make it easier and more rewarding for their customers to spend with them directly, capturing and retaining more wealth in their ecosystem.

We enable brands to enhance their existing loyalty programme by allowing customers to earn or redeem rewards automatically when making purchases, eliminating the need for separate loyalty cards or processes.

Omnio’s low-cost banking-as-a-service liberates banks and financial institutions from expensive legacy systems, empowering them to transform the entire banking experience for their customers.

Our user-based subscription model slashes upfront costs and eliminates expensive infrastructure investments.

Easily adapt to changing market conditions and consumer needs with easy to integrate customisable solutions.

Maximise your efficiency and scale your operations at speed, reducing your resource requirements.

Protect customers with bank-grade security, including advanced encryption, multi-factor authentication and regular security audits to ensure data integrity and compliance.

Deliver seamless and personalised customer with a comprehensive view of each customer to tailor products, services and support.

Our cloud-based technology and services provide a modern and secure foundation for competing in the rapidly evolving digital banking market.

We enable brands to enhance their existing loyalty programme by allowing customers to earn or redeem rewards automatically when making purchases, eliminating the need for separate loyalty cards or processes.